Double Bottom

The Double Bottom graphical price pattern is a chart formation that usually indicates a reversal of a current downtrend. It is generally in the shape of the letter “W.”

The formation of the Double Bottom pattern

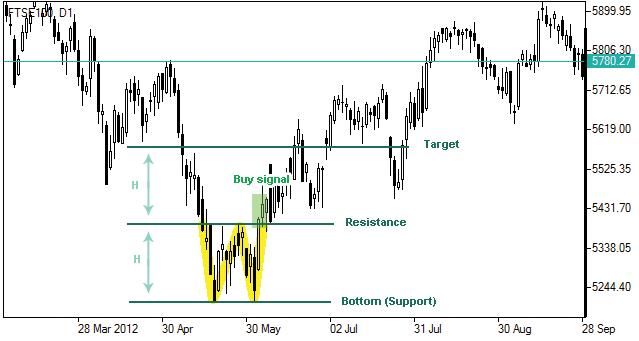

The structure of the Double Bottom pattern is distinct as it is roughly similar to the Latin alphabet “W.” This shape consists of the two lowest price points that were reached recently, and below it, a line drawn would be considered as the support line. The most recent high (before the low points) would determine the resistance line and hence, the signal to buy. Doing so would create the lines as seen below:

Interpreting the Double Bottom

Once the support and resistance lines are determined, analysts can now spot or visually see either the price direction heading on an upwards trend or see it as an indicator to buy. The signal and/or confirmation can be decided when the market direction crosses above the resistance line.

The formula for determining target price for the Double Bottom formation

To decide on what price would be the signal to buy, the target price for the Double Bottom formation would be as follows:

T = R + H

Where:

T – Target Line

R – Resistance Line (determined from the local high)

H – Height of the Pattern (determined by the distance between the support and resistance lines)