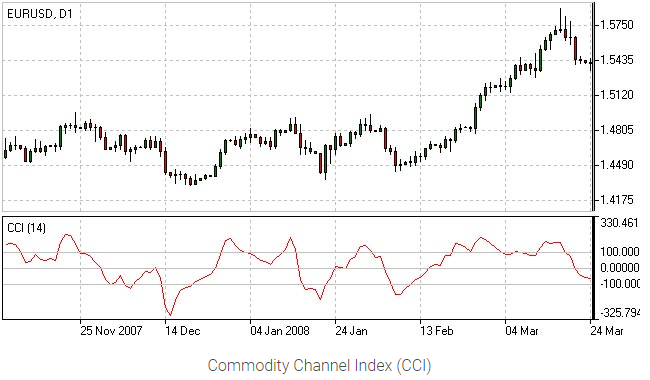

Commodity Channel Index (CCI)

The Commodity Channel Index, introduced by Donald Lambert in the 80s, is a technical analysis indicator initially created to spot new market trends. Today, it has also been adapted to measure current price levels following its average value.

Using the CCI indicator when trading

The Commodity Channel Index is an oscillator that fluctuates from a naught line within the territory ranging from -100 to +100, where the naught line represents the level of an average price that has been balanced.

The higher the CCI indicator moves above the naught line, the more value the particular asset has. However, if the CCI indicator were to plummet into the below-zero territory, this would mean that the asset has the potential for growth.

The unbalanced value in itself may have the chance to not serve as clear indicators for the current price trend or the security’s strength in the market. The following are values that are crucial and must be looked at carefully.

- When the indicator readings exceed past the +100 level, this would suggest that the price could take an upward movement in the market.

- When the indicator readings decrease past the +100 level, this would mean a change in the current pattern. This would serve as a signal to sell.

- When the indicator readings exceed past the -100 level, this would suggest that the price could take a downward movement in the market.

- When the indicator readings decrease past the +100 level, this would mean a change in the current pattern. This would serve as a signal to buy.

- An indicator reading that crosses the naught line from negative territory serves as a signal to buy.

- An indicator reading that crosses the naught line from the positive territory serves as a signal to sell.

Setting the CCI indicator for a shorter period would increase the sensitivity of movement. Shifting critical levels to 200 would allow you to eliminate fluctuations in price that may be deemed insignificant.

Incorporating the CCI Trading Strategy

Modern traders, investors, and analysts use this technique as an oscillator to determine market assets as either ‘overbought’ or ‘oversold’. Put the CCI trading strategy involves keeping a close eye on the interpretations that go above the +100 and -100 threshold. From here, any readings that crosses pass the said lines would roughly determine the signal to use the buy or sell option. Any reading that crosses above the +100 threshold is considered as ‘overbought’ and is a signal to buy, and any reading that crosses below the -100 threshold is considered as ‘oversold’ and is a signal to sell.

Initially, the Commodity Channel Index was developed for commodities, though; nowadays, it can also be used for trading stock index futures and options.