World billionaires experience wealth decline for the first time in ten years

World billionaires’ wealth fell for the first time in a decade due to geopolitical unrest and fluctuating equity markets. According to the Union Bank of Switzerland (UBS), the world’s richest people experienced a decline in their wealth last year.

Overall, billionaires’ wealth reduced between $388 billion and $8.539 trillion all over the world, with an obvious decline in Greater China and the broader Asia-Pacific region.

The US-China trade war has affected many businesses around the world, especially private banks whose clients refrained from trading and taking on debt due to uncertain global politics.

“Billionaire wealth dipped in 2018 for the first time since 2008 because of geopolitics,” said Josef Stadler, head of ultra-high net worth clients in UBS.

China’s richest people dropped 12.8% in their net worth in dollars due to tipping stock markets and weakened Chinese currency. China’s economy, the second largest in the world next to the US, slowed down near its lowest level in almost three decades last year, knocking off dozens of billionaires from the list.

In spite of the decline, China still produces a new billionaire in 2-3 days, Josef Stadler said.

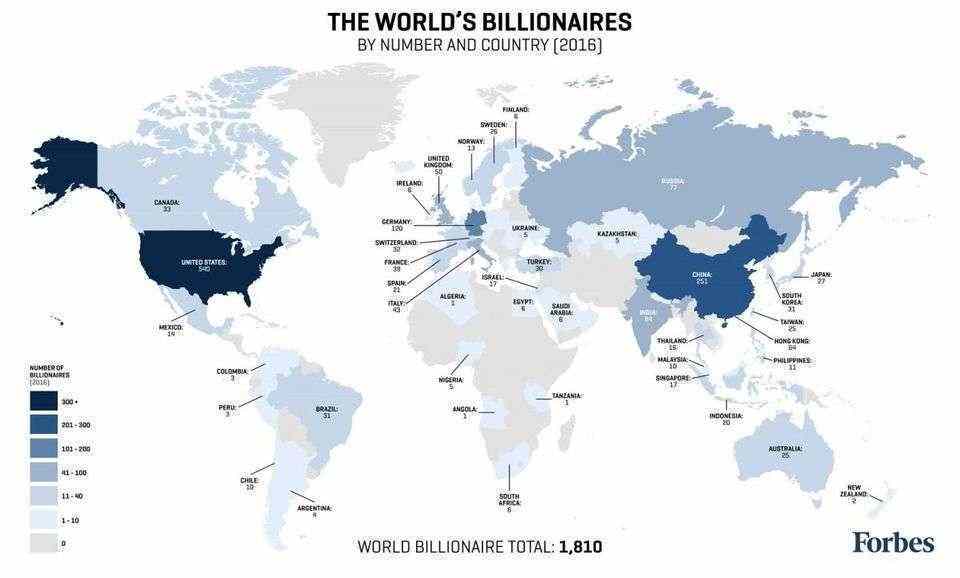

The number of billionaires across the world suffered decline except in the Americas, where tech entrepreneurs continue to lead the list of wealthiest people in the US.

“This report shows the resilience of the US economy,” said John Matthews, head of private wealth management and ultra-high net worth business for UBS in the US. By the end of 2018 the US had 749 billionaires on the list.

As a recovery in the stock market from its sharp drop in late 2018 has aided wealth managers to increase their assets, the world’s wealthiest remain worried about current global affairs. The still ongoing trade turmoil, Brexit, and climate change have prompted billionaires to keep more of their money in cash.

“It is likely that billionaire wealth will go up again this year,” Simon Smiles, chief investment officer for ultra-wealthy clients, said. Smiles added that a more muted increase might take place instead of the wider financial market rally suggests.