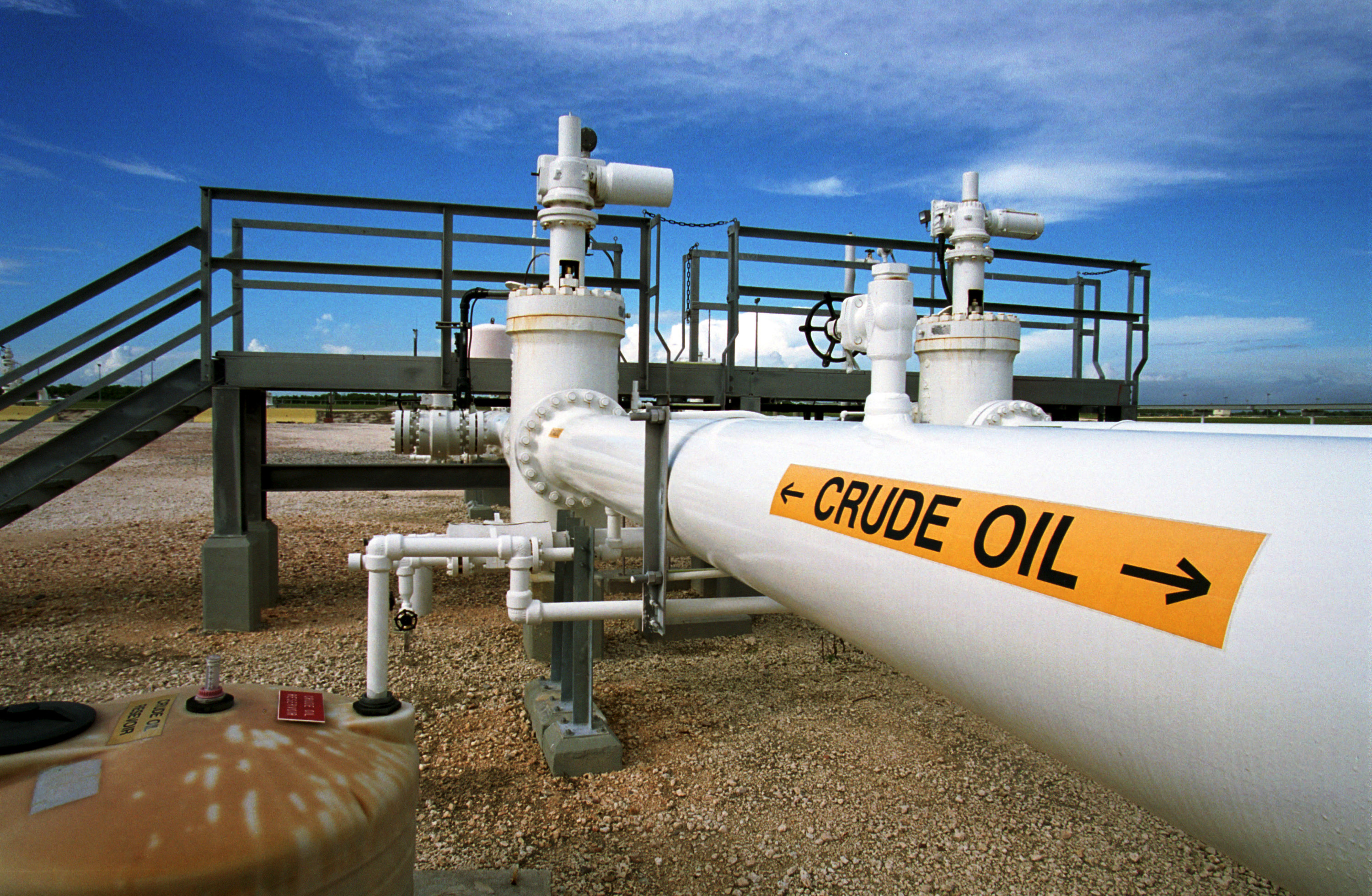

Oil dips as coordinated reserve release dispel concerns

Oil prices went down on Wednesday following a United States-led coordinated release of stocks from strategic reserves that allayed worries over tightness in global supply. Meanwhile, investors raked profits from the previous day’s rally ahead of the Thanksgiving holiday in the U.S.

U.S. West Texas Intermediate ( WTI) crude futures edged down 0.2%, or 12 cents, to $78.38 per barrel at 0122 GMT, while Brent crude futures dropped 0.4%, or 32 cents, to $81.99 per barrel. WTI and Brent were up 2.3% and 3.3%, respectively, during the previous day.

The U.S. stated on Tuesday that it would release millions of barrels of oil from strategic reserves in coordination with Britain, India, Japan, South Korea, and China in an effort to tame prices after OPEC+ producers did not heed their repeated calls for additional crude.

Crude stocks increased by 2.3 million barrels for the week ended November 19, beating analyst expectations of a decline by around 500,000 barrels. Gasoline inventories added about 600,000 barrels, while distillate stocks decreased by 1.5 million barrels.