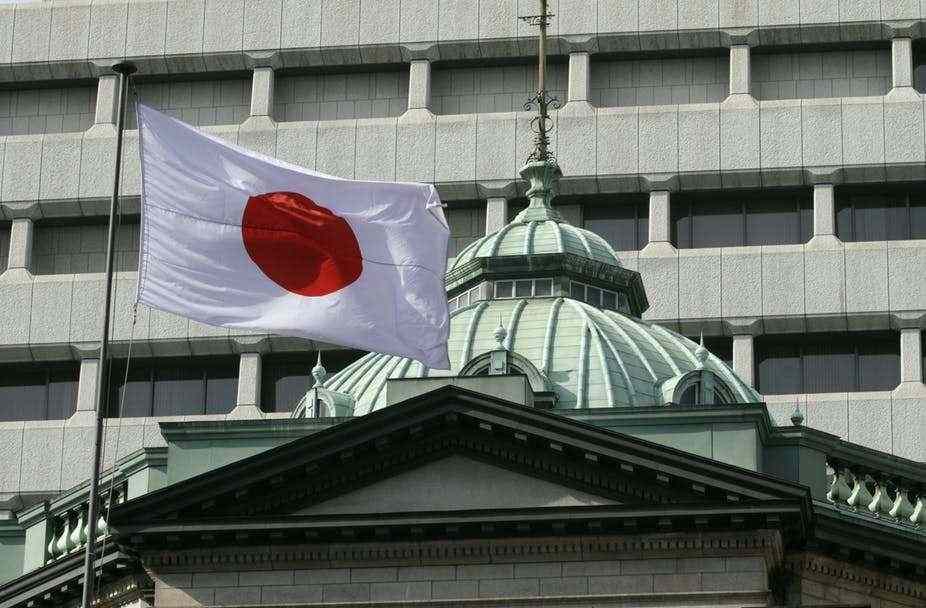

Japan suffers economic woes, BOJ under pressure

Japan’s core consumer inflation barely recovered in January. This had put pressure on the Bank of Japan to maintain its massive monetary stimulus to underpin the economy weakened by slow growth and weak prices.

Tame inflation is cause for worry in Japan’s economy still saddled by the virus impact. The BOJ expressed no interest to add another monetary stimulus, as it would add little to no help in combating a financial crisis.

BOJ Governor Haruhiko Kuroda said he would consider another easing if the virus’ impact threatens the country’s economy and inflation.

The core consumer price index, including oil products, but not volatile fresh food prices, climbed 0.8% in the year to January. It followed a 0.7% increase in December, meeting economists’ median estimate.

Price trends would be weighed by weak wage growth and slipping corporate profits, as well as decline in tourism.

Exports dropped again in January and GDP endured its biggest contraction since 2014. Japan’s economy decreased 6.3% in October-December, the biggest decline in six years, due to the tax hike, warmer winter, and typhoons.

Analysts expect a contraction in the current quarter, possibly leading to a recession. China, Japan’s major exports market and the center of global supply chains, suffers the impact of the virus.

Japan’s factory activity fell to its deepest level in seven years, highlighting the epidemic’s impact on global growth and business and emphasizing a gloomier outlook for Japan.