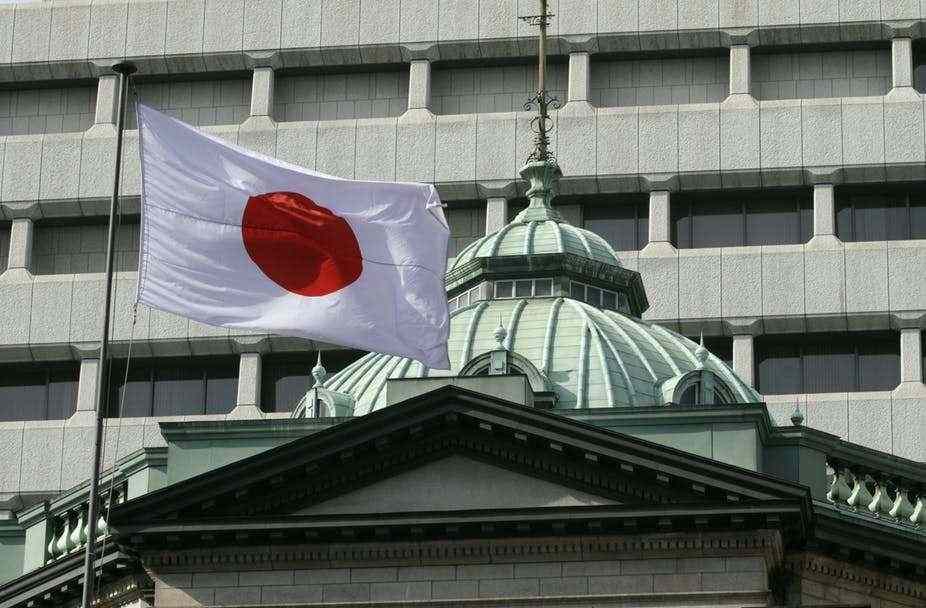

Japan assails U.S. digital tax proposal during G20

Japan, represented by Finance Minister Taro Aso, assailed the tax reform proposal presented by the United States saying that it could compromise or disable global efforts to agree on new rules in imposing taxes on huge tech firms.

The finance leaders of the Group of 20 (G20) major economies of the world are campaigning a movement in tax reforms as the Organization for Economic Cooperation and Development (OECD) is now plotting new rules to oblige giant digital companies to pay taxes where they are formally operating their businesses instead of where their subsidiaries are registered.

However, the OECD tax reform initiatives were dodged in 2019 as Washington made last minute-changes which underscored a “safe harbor” provision which pertains to different leaders’ liberty of choosing between abiding by the newly-imposed reform or remaining religious to the existing policies.

“I told my counterparts that Japan is very concerned about the safe harbor proposal. It would extremely diminish the regulatory effect of what we’re trying to do. That is a view expressed by various countries,” said Aso at the G20 summit.