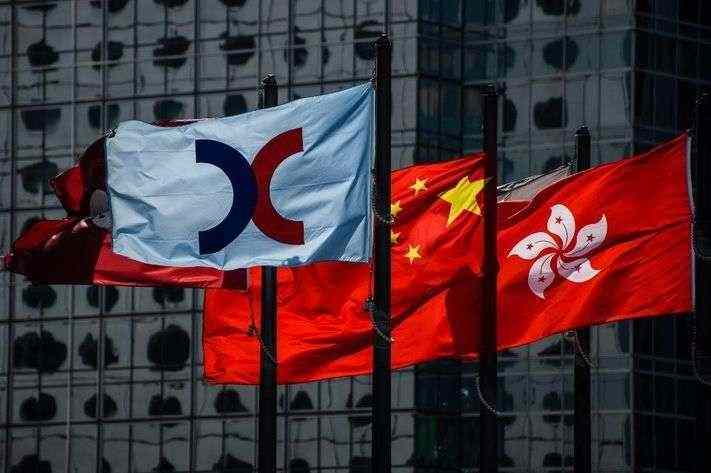

CHINA, HK STOCKS SUFFER AS SINO-US TENSION BRINGS MARKET ANXIETY

SHANGHAI-Hong Kong’s benchmark index plunged down with 2% loss on Friday brought heavily by recent trade dispute headline about US legislation supporting Hong Kong protesters.

Hang Seng index shed 2% at 26,363.78 points as Hong Kong Enterprises Index inched down with 2.4% loss to 10,309.46. Such inactivity was brought by tensions between the United States and China after the US government signed a law to back up anti-government protesters in Hong Kong.

China released a warning of coming up with “firm counter measures” as a retaliation to the said legislation, saying that it is affront to their sovereignty and security.

“The main concern is still the trade deal,” said Alex Wong, a director at Ample Finance Group in Hong Kong.

“We are in thin trading, so as we break out on the downside some people will chase (the sell-off),” he added.

Market anxiety also grew as investors worried about further economic harm as the island city faced weekend political unrest.

Hong Kong prepared for upcoming rounds of unrest as police on Friday withdrew from invading the vicinity of university, the site where most notorious clashes between protesters and authority happened.

Hong Kong private home prices suffered for fifth consecutive month in October as Asian financial hub lost momentum from the worst political mishap in decades. Despite such drag, decline movement was slow.

“Looking at the social and market situation, the price index will continue to decline in November and December,” said Thomas Lam, executive director of property consultancy Knight Frank.

The possibility of luxury brands retreating is high as the city is ransacked by political crisis at a time when upper class Chinese shoppers are residing on the mainland.

Mainland’s stocks were stable boosted by healthcare sector following major stakeholders’ price cut-off in China.

The CSI300 index lost 1% to 3,823.22 points before closing its early session while the Shanghai Composite Index shed 0.6% to 2,871.08 points.

Across the region, MSCI’s Asia ex-Japan stock index plummeted 0.99%, while Japan’s index Nikkei inched lower with 0.25% loss.

The yuan was quoted 7.0325 per dollar and was 0.03% more stable than its precedent session of 7.0348.

Shanghai stock index has a total acquisition of 15.87% this year as China’s H-share index soared with 4.3% earnings. Shanghai stocks dropped 1.34% this month.

China’s A-shares reached a premium of 29.49% compared with Hong Kong-listed H-shares at 0423 GMT.