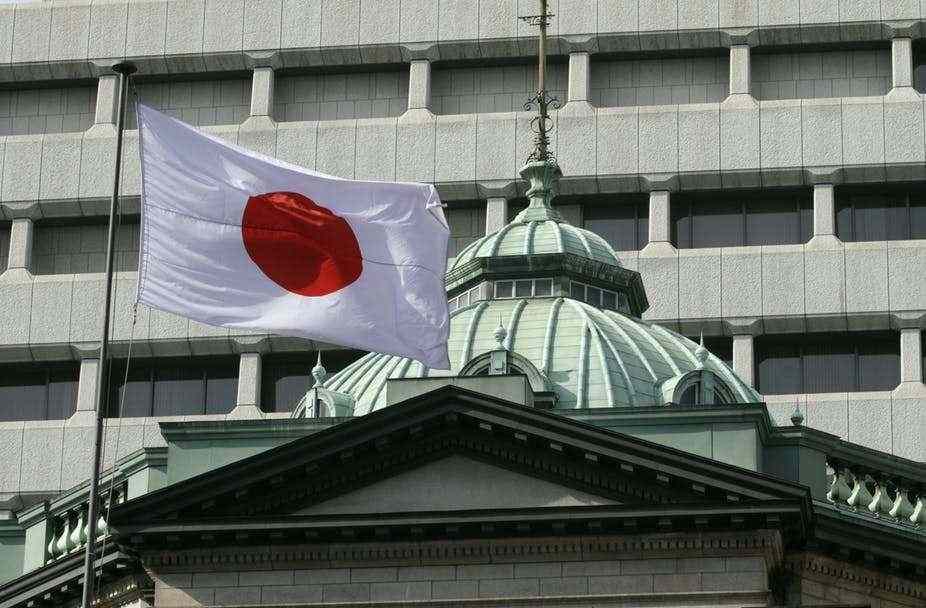

Bank of Japan scrutinizes markets for “very unstable” moves, exposes cost of ETF buying

Bank of Japan Governor Haruhiko Kuroda said he was analyzing the financial blowback from volatile market movements. Kuroda confirmed central bank’s preparedness to take appropriate action to increase assistance in obstructing the developing dangers from the coronavirus flare-up.

He also disclosed the BOJ’s prediction which revealed its holdings of exchange-traded funds (ETF). Paper losses may profit once the Tokyo’s Nikkei stock average falls down to 19,500.

“There’s uncertainty on when the coronavirus will be contained, and markets are making very unstable moves,” Kuroda warned parliament on Tuesday. “We’ll continue to keep an eye out on how the spread of the virus could affect Japan’s economy and prices, particularly via domestic and overseas market developments, and act appropriately as needed without hesitation,” he said.

Rumors in the market say that the BOJ could guarantee to bargain ETFs at a quicker rate than the present deal to do so by approximately 6 trillion yen ($58.12 billion) per year. Kuroda said in the parliament that the BOJ had purchased 2.04 trillion yen worth of ETFs since October 2019.

Since then, the BOJ has been speeding up the rate of ETF buying. It bought 100.2 billion yen ($979 million) on Monday, tallying a record rate of purchases made twice last week.